XBE vote almost over! Where to next?

May 28, 2021

4 Minute Read

If you haven’t yet voted on the first XBE protocol upgrade proposal, you still have time till later today!

With our first community vote almost complete we’ve been overwhelmed by the support for our proposal to upgrade the protocol with a CRV style reward mechanism, and the addition of the xbEURO non-inflationary stabletoken to capitalise future interests on tokenised securities! We look forward to formally announcing the results on our socials later today, so keep an eye out - and we will follow up early next week with more information on what you can expect next (depending on the vote)!

If you have not yet voted, visit the snapshot page now to cast your vote together with the over 5,000 XBE in voting power that has already done so before it closes!

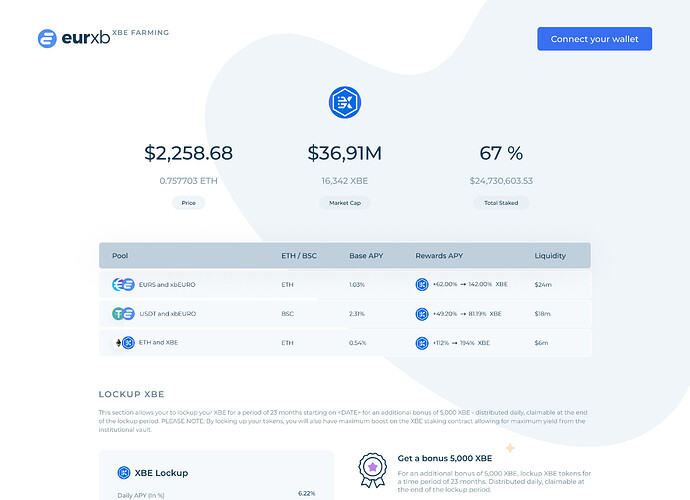

As a big thank you to everyone that has participated in the vote, we wanted to share this sneak-peak of what the official dAPP UI could look like if the proposal features are implemented:

Proposed Revised Official APP UI

The more astute community members have noticed that we mentioned “Q2” as our product timeline in the recent AMA we held, and whilst (as usual) we can’t give away specifics, product deployment is still on track for that target. As with all our product releases however, this is still dependent on the outcome of audits and therefore subject to change!

Crypto is going through a more volatile time than usual with the recent market price activity - and many community members have asked how XBE and the protocol would stand up in a bear market. We don’t have a secret portal into the future unfortunately - but we do think that the success of any protocol or token that is ultimately based around the creation and trade of stable denominated assets tend to do much better in bear markets than those that derive their revenues from pure demand side tokenomics. The bigger question we think that should be considered is actually how more new users could be brought into the crypto universe - as a bear market is really the result of a net outflow of value from crypto, which is tracked by the (recently painful) changes in total crypto market cap value.

So, can tokenising securities attract more FIAT based investors to Crypto?

Tokenising securities creates new instruments that traditional investors are more comfortable with, and can adapt to with less concern or uncertainty than the majority of cryptos available today due to their familiar origins in the regulated market - however the real benefits to these new traders can only be unlocked once they participate in the new and innovative opportunities that DeFi has created in a new world of transparent finance!

In much the same way, whilst it is a massively important and positive step to tokenise a security as it exposes traditional value to DeFi (and the larger crypto community), the tangible benefits for DeFi only really becomes apparent once traditional investors start to exchange their FIAT for these tokenised securities - contributing towards more FIAT buying pressure against the overall crypto market - even though that is happening anyway at the maturity or pay-out date of the aforementioned security when the issuer settles up tokenised liabilities with their FIAT.

Therefore the on-ramp for new traditional users from FIAT into tokenised securities is almost as important as being able to tokenise the security itself and offering a return on it!

Filling-in this key step in between the big picture pieces we’ve already shared is an on-going effort with prospective partners in many regulatory jurisdictions, as we build out the protocol to effectively bridge the securities market and DeFi. In fact, during bear markets these efforts are even more important - because it creates access for new FIAT users to come into the crypto market, and provides these new users with new types of regulated security backed instruments that do particularly well during bear markets thanks to their stable value.

As stable assets take up a larger share of overall crypto valuation (as we normally see in a bear market), we hope to see the proportion of tokenised securities rapidly grow to represent a large share of that stable denominated value, and give both traditional and crypto users more options to on- and off-ramp their capital between diverse instruments as they seek the most profitable strategy during any market!

We have also been hard at work on the product development side, and here is a status update for those very patient community members that’s been dying to find out!

Development Update

With what appears to be a successful vote for XIP1, the founding team has already completed/currently wrapping the following modules so we may begin audits to adhere to our Q2 deployment timelines.

Please again note that this timeline is subject to change - pending audits.

(The additional modules we are working on are also included for transparency.)

- Gauge Controller contract

- Minter contract

- Voting Escrow contract

- Voting (veXBE)

- Boost Mechanisms for staked vs locked XBE

- Bank Module for xbEURO

- Fee mechanisms (Protocol fees for minting xbEURO)

- Layer 2 Markets

- Layer 2 Futures Markets

- Layer 2 Permissioned environment (deployed for our central bank clients)

- xbEURO and Institutional Vaults

- Bank module support for new tokens (EURxC, EURxD etc)

The Front End items for on-chain governance voting and the XBE farming are currently being tested. These front end items will be released when the smart contracts are deployed.

Looking forward to announcing the voting results soon!