Introducing The xbEURO: a capitalised interest, non-inflationary stablecoin

April 23, 2021

A vision for an integrated financial market means that we need to easily integrate with both more DeFi and TradFi instruments: Hello xbEURO!

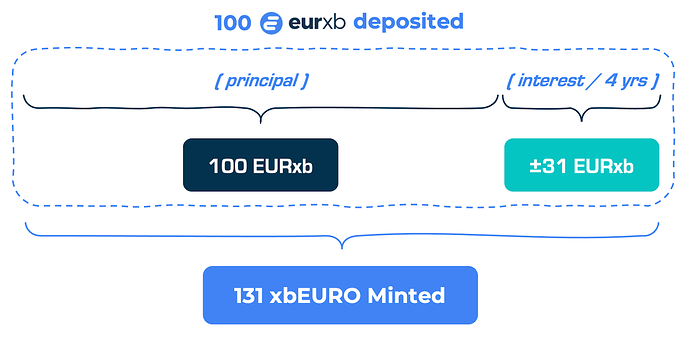

We are excited to announce the xbEURO - a non-inflationary stablecoin that allows holders of our inflationary stablecoins (currently the EURxb, with more to come in future!) to lock-up their tokens for the full interest term. This mints the full value of their entire future term interests together with the current capital value in new xbEURO stablecoin tokens, to be deployed into liquidity pools that earn protocol rewards!

*Locking EURxb tokens to mint the interest and principal as xbEURO tokens.*

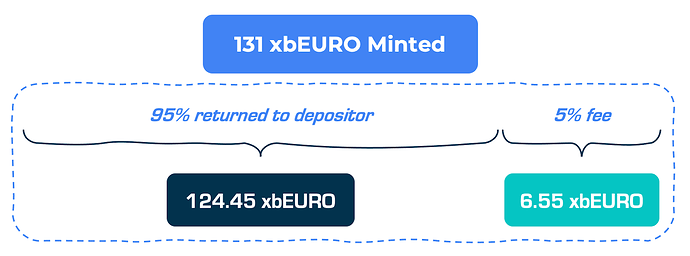

This product is also our first protocol fee model, returning 95% of the total issued xbEURO to the depositor and keeping the balance as a once-off protocol fee irrespective of the interest term.

EURxb depositor receives 124.45% the EURxb liquidity in xbEURO (after protocol fee)

Over and above this addition to our other protocol tokens, we are making important progress on preparing for an open protocol that will support new issuers in the future. The xbEURO (and future xbFIAT stablecoins) are designed to provide a completely fungible instrument that allow different types of securities to access the same liquidity pools, simplifying how we will manage liquidity as a protocol. It also ensures that we can reliably interface with other DeFi pools and protocols that do not yet fully support an inflationary token, and goes one step further in clarifying potential future regulatory concerns around interest bearing tokens.

So how specifically does xbEURO help us progress towards a more open protocol?

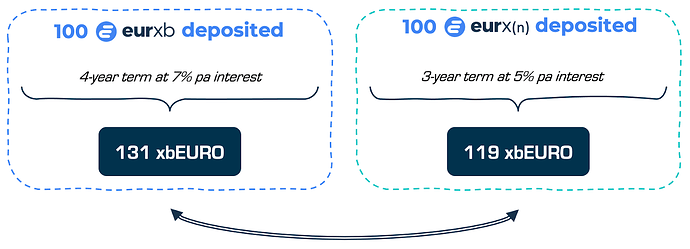

As an example, the EURxb is a 7% pa over 4 year term inflationary stablecoin, following the terms of the Overcollateralised Senior Secured Miris Green Bond (tokenised through the protocol’s NFT721s), of which the principal and interest proceeds serve as protocol reserves that back the protocol issuance of EURxb tokens.

However, not all debt securities mature at the same time, and nor do they pay the same rate of return - so expanding the use of the current EURxb token would require working with parties that would match these initial terms. Using the xbEURO as a common instrument - we can issue new NFT721s that encode the term and rate (let’s say 5% pa over 3 years) of a different security to generate another EURx(n) inflationary ERC20 token that itself can be locked up to mint xbEURO. In this way, all EUR denominated securities will be able to access the xbEURO liquidity to interface with other DeFi protocols!

xbEURO creates a fungible bridge for different rate and term inflationary instruments

The most important protocol feature that the xbEURO enables – and by far the most exciting part of our update today – is the ability to support regulated equities and other non-debt based securities, and integrate them within the protocol going forward.

In fact, by adding the xbEURO to our protocol portfolio we have taken a major step towards providing new NFT721 token mechanisms that collateralise instruments from the approximately $70tn regulated global equities market, in order to provide tangible term based DeFi liquidity at an individualised overcollateralisation ratio and interest rate.

By expanding the potential types of regulated securities we can tokenise and hold as protocol reserves we substantially increase the utility and scope of instruments we can provide DeFi benefits to. We can even begin to imagine applications as diverse as public ventures using their equity to directly participate in DeFi, and offering the same options to their shareholders, in essence creating immediate liquidity against long-term illiquid market assets… It could even change the way we think about the repurchasing markets.

We know there is quite a lot to expand on here, and will take time to do so in a following update! Now let’s get back to the present.

With the imminent launch of our governance forums, we are finally ready to publish details on how the XBE Institutional Vault product works - so get ready to participate in the discussion! As this matures we will also be able to use this platform to reveal and debate the founder’s proposal for XIV earning strategies.

The core focus of our yield strategies will not only ensure protocol fees (to provide our own sustainable yield methodology), but also the yield itself. As we progress on our roadmap we may have to start out being limited to the volume of counter asset liquidity we attract from the market, and this means that we have to consider how we can generate competitive yield values to attract market participation (and to generate returns for staked XBE) regardless of the value of the deployed capital in the institutional vaults.

Since we haven’t had an opportunity to provide a proper update in a while – we wanted to include some quick development updates for you as well in this post:

A. Audits are going well – our auditors (Peckshield & SFXDX) are currently finalising their respective audits for the following modules:

- Vaults

- Bank Module (Securities)

- Bank Module v2 (xbEURO)

- Incentive Contracts for Yield Strategies

- Various Protocol NFT and Minting Contracts

B. Protocol yield strategy proposal is currently in internal review before we release for publication (very soon).

C. Once complete, we can finally kick off the big public community discussion on this important topic, including the initial strategies for the XBE protocol consisting of the following:

- Introduction of the protocol fees

- Additional base yield strategies

- Additional surplus yield strategies

- DeFi Integration plans + partners

D. Additional governance contracts will begin once further audits have completed

E. Our front-end teams have started on our governance UI, and we are also busy finalising the updated staking UI for XBE holders (we’ll release these very soon too).

F. Layer 2 development is on-going – we will release more on this when it’s ready.

Keep following our socials for news on our next update!