EURxb and XBE Token Launch Distribution Schedules

March 20, 2021

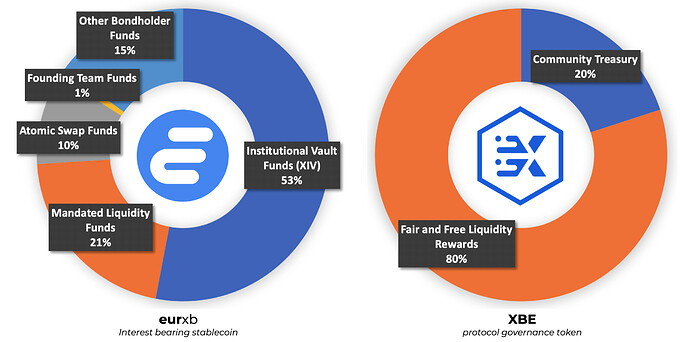

Here is a breakdown of the 100m EURxb stablecoins and 15,000 XBE governance tokens recently launched by the EURxb protocol.

Eurxb.finance has two ERC20 type tokens that drive the operation of the platform, namely the EURxb interest bearing stablecoin and the XBE governance token.

The stablecoin is backed by the protocol’s bond reserves, tokenised in the form of both the EBND ERC721 NFT real-world bond subscriptions as well as the collateralised ESAT ERC721 NFT real-world security assets pledges, but we will do a deeper dive on them and the critical role that NFT’s play in the EURxb Protocol in another post.

EURxb (Interest Bearing Euro Stable Coin):

Real-time compounding ERC20 token that pays 7% interest per annum and represents a fractional call on the protocol reserves.

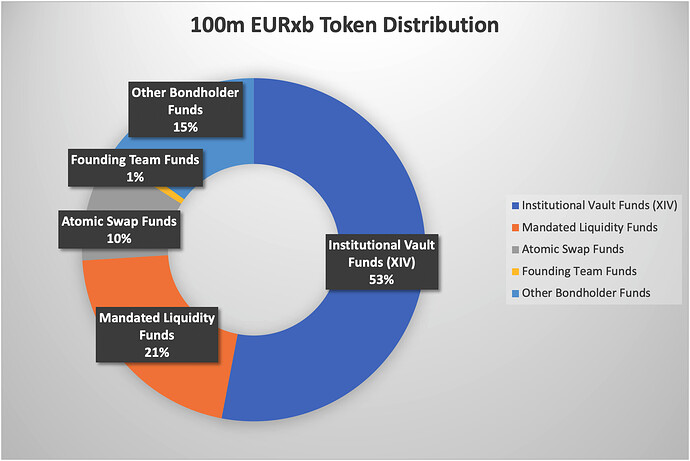

Per the secondary market assignment of 100m Euro of Miris’ Senior Secured Green Bonds, all EURxb tokens were originally distributed to bondholder mandated addresses for respective protocol objectives. These included the allocation for the XIV, future liquidity programs, atomic swap module, as well as specific bondholder addresses.

EURxb launch token distribution schedule is as follows:

EURxb Launch Token Distribution

XBE (Governance Token):

ERC20 governance token that affords the holder the right to vote and earning reward fees when staking in the upcoming governance contracts.

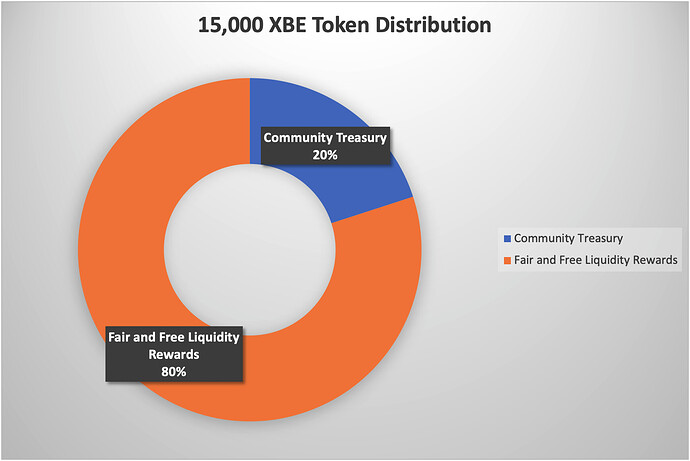

Per the launch liquidity incentive program 12,000 of the 15,000 XBE governance tokens were distributed to liquidity providers across the 4 initial EURxb stablecoin pools, which concluded on Wednesday 3rd of March at 11h00. With no investor or founder allocations, this was a fair and free distribution to early-bird liquidity providers.

XBE launch token distribution schedule is as follows:

XBE Launch Token Distribution

Notable disclosures:

The founding team is actively buying XBE in the market, and intends to hold a substantial amount of XBE in order to consistently participate in governance proposals long term.